How can I stake cryptocurrencies?

For both beginners and advanced users in the cryptocurrency universe, the many terminologies can easily become overwhelming. Therefore, we have made it our mission to present the most important information in this context as simply as possible.

One of the terms that is becoming increasingly common is staking. This refers to an energy-saving and thus environmentally friendly method of putting your cryptocurrencies to work for you.

What is crypto staking?

Imagine you have a piggy bank, but instead of just putting your money in it and leaving it there, you lend it to the bank. As a thank you for lending your money to the bank, it gives you some extra money over time. This is similar to what people do when they put their money in a savings account.

Now, let's talk about crypto staking. In the world of cryptocurrencies, staking is akin to lending your digital money, except you don't give it to a bank, but use it on a cryptocurrency network. By “staking” or locking up your cryptocurrencies, you help the network to operate securely and efficiently. As a thank you for your assistance, the network pays you a reward in the form of more cryptocurrency.

What is Proof-of-Stake?

Proof-of-Stake (PoS) is an alternative algorithm to the Proof-of-Work used by Bitcoin. It's an environmentally friendly process and consumes less energy compared to crypto mining.

In practice, this means that your coins are not created through mining, but “validated”. Those who wish to be validators must deposit a certain amount of cryptocurrencies and are then rewarded with the mentioned interests for doing so. This entire process is referred to as staking.

Sunny King and Scott Nadal introduced Proof-of-Stake in Peercoin. They published the paper in 2012. The authors derived the idea from the Bitcoin model of Proof-of-Work.

What is a staking pool?

A staking pool is formed when a group of people join together to combine their resources or just cryptocurrencies. They do this to increase the chances of validating blocks and earning more rewards. Maintaining a staking pool requires a lot of time and resources, though the long-term effects are beneficial.

What is cold staking?

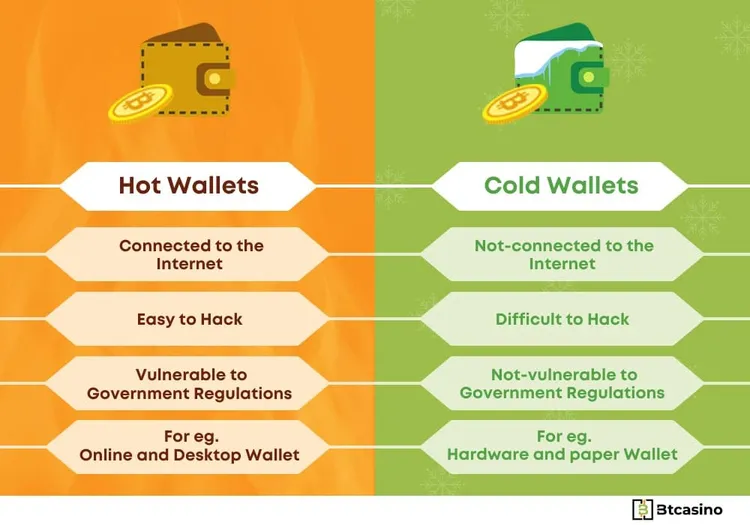

A cold wallet is an offline wallet, which means it is not connected to the Internet. So, when we discuss cold staking, we mean staking with a wallet that is not connected to the Internet. With this type of staking, you need a hardware wallet.

How can I stake cryptocurrencies?

Staking cryptocurrencies is easy, compared to crypto mining. Here we explain the process step by step.

1. Choose a cryptocurrency

Before you choose a coin for staking, you should learn about the different cryptocurrencies. Each cryptocurrency has its uses. Moreover, you can't stake just any cryptocurrency. To participate, you must be in possession of a proof-of-stake currency.

Take your time to pick the right cryptocurrency. Do not be blinded by the amount of interest. Staking is an investment over a long period of time. So, the project you select should be solid and even in several years in the best case, not lose value.

Here are a few cryptocurrencies to consider for staking:

- Ethereum (ETH)

- Solana (SOL)

- Terra (LUNA)

- Polkadot (DOT)

2. Choose the type of wallet

We have already discussed the different types of wallets and their advantages and disadvantages in another article. To be able to hold cryptocurrencies, you cannot avoid creating a wallet. This can happen via the mentioned hardware wallets, but also directly on a crypto exchange.

3. Buy your cryptocurrencies and start staking them

Once you have created your wallet, it is time to purchase cryptocurrencies. The easiest way to do this is via one of the many exchanges. There you can deposit your account or another means of payment and directly purchase your desired coins.

Note: Not all cryptocurrencies can be staked, as staking is mainly possible with currencies based on the Proof of Stake (PoS) or similar algorithms.

Proof of Work (PoW)-based cryptos like Bitcoin do not support staking.

Staking is used to increase network security and reward participants for their contributions. Examples of stakeable currencies include Ethereum 2.0, Cardano, and Tezos. Participation typically requires depositing coins into a compatible wallet, and the conditions vary by blockchain, including minimum amounts and holding periods.

Where can cryptocurrencies be staked?

Staking of cryptocurrencies is on everyone's lips. And not without reason. It is a lucrative source of income for end users as well as intermediaries. Accordingly, there are now numerous providers that make staking available.

Well-known crypto exchanges like Coinbase or Binance offer this service. If you don't have any cryptocurrencies yet, you can do everything from creating the wallet to staking with one provider. This is particularly convenient.

However, there are now also smaller companies that offer staking but do not sell any cryptocurrencies. We generally advise you to choose a well-known provider. At the end of the day, it's your money that you want to invest as safely as possible, but at the same time profitably.

When should I do staking?

Whether you're investing in cryptocurrencies or just interested in them: You can't get around the word “Hodl.” This term comes from a 2013 forum post titled “I AM HODLING.” It is a typo that has left a lasting mark on the crypto scene.

This holding strategy is used by many investors to avoid trading losses and taxes. If you have also taken this path, Statking is made for you. This way, you can add more profits to your cryptocurrencies, which you have assigned to a longer holding strategy anyway, and take advantage of the compound interestst.

Advantages and disadvantages of staking

| Advantages | Disadvantages |

|---|---|

| High security | For proof of ownership, there must be 24/7 internet connection |

| High scalability | Promise of high rewards attracts scammers |

| Low barrier to entry | Coins are partially blocked for a longer period of time |

| Less energy consumption than mining |

Conclusion

Proof-of-stake offers numerous advantages over the proof-of-work mechanism. The focus is on the environment, which should solve a major problem of mining.

The validation of blocks and thus the verification of transactions leads to partially high rewards in staking.

This incentive as well as the low barrier to entry continue to promise a rosy future for staking. Especially considering the banks' low-interest rate strategy, this type of investment offers a lucrative alternative for more and more people.

FAQ Crypto Staking

Staking is generally safe, but involves risks, especially due to the fluctuating value of cryptocurrencies and possible security vulnerabilities in the technology. Choose a trustworthy platform carefully and be aware of the risks.

APY stands for “Annual Percentage Yield” and describes how much money you can earn with your staked crypto over the course of a year, expressed as a percentage.

Staking pools are like teams where people join together with their cryptocurrencies to participate in the staking process. Individuals may not have enough coins to effectively stake on their own or meet the technical requirements.

By pooling their resources, they can more easily meet the minimum staking requirements and increase their chances of earning rewards. The rewards are then distributed proportionally among everyone in the pool based on each participant's contribution.