Bitcoin Casino - Online Provider Comparison 2024

Bitcoin casinos are currently the talk of the town. The popular cryptocurrency is recording constant growth on average, despite all the negative forecasts. But what is the reason for the remarkable success of the digital currency and what exactly is Bitcoin?

With these basic questions, this article is aimed at interested parties and users who are planning to acquire Bitcoin themselves. Whether you are planning a large or small investment in the cryptocurrency, our relevant guide will provide you with the most important basic knowledge.

The best BTC Casinos in Comparison in April

Table of Contents

- The best BTC Casinos in Comparison in April

- The top 15 Bitcoin casinos in direct comparison

- What is Bitcoin?

- Crypto gambling & Bitcoin gambling: Our guide for casino players

- Which Bitcoin casino should I start playing at?

- Step-by-step guide to registration and first deposit

- Which casino games are suitable for bitcoin gambling?

- Advantages and disadvantages at a glance

- Bitcoin gambling: Advantages

- Bitcoin compared to traditional payment methods

- BTC gambling: Possible disadvantages

- Why is Bitcoin the most popular currency in cryptocurrency casinos?

- Different units of Bitcoin

- The game selection at BTC casinos

- Possibilities of a Bitcoin Casino Bonus

- Bonus Glossar

- Deposits and withdrawals at Bitcoin Casinos

- Secure storage options for Bitcoin

- Bitcoin as an investment

- Bitcoin alternatives

- Bitcoin Mobile Casino

- A Bitcoin casino represents a strong opportunity for casino and crypto fans!

- Bitcoin Casino FAQ

The top 15 Bitcoin casinos in direct comparison

Before we take a closer look at Bitcoin as a cryptocurrency and its facets, you can find a clear comparison of our best casinos here:

1. TrustDice

TrustDice stands out as a Bitcoin Casino with its innovative use of blockchain technology. As a player, you're greeted with a wide array of games, ranging from classic slots to exciting table games. What makes TrustDice special, however, is its transparent and secure gaming environment enabled by blockchain technology. The casino also offers regular bonuses and promotions, making it particularly attractive for regular players.

- Wide range of games, from slots to live casino

- Transparent and secure gaming environment thanks to blockchain

- Regular bonuses and promotions

2. Gamdom

Gamdom is more than just a BTC Casino; it's a comprehensive gaming platform, especially known for its eSports betting offerings. Alongside an impressive selection of casino games, you can bet on the biggest eSports events here. Gamdom stands out for its fast and secure transactions, ensuring a smooth gaming experience. The intuitive user interface and appealing design of the website make navigating and playing a real pleasure.

- Unique offering in eSports betting

- Fast and secure transaction processing

- Intuitive user interface and appealing design

3. Metaspins

Metaspin positions itself as a futuristic Bitcoin Casino, offering an impressive selection of games. This casino impresses with its modern graphics and innovative game features, providing an entirely new level of gaming experience. You'll find everything from popular slot games to classic table games, all in a cutting-edge digital atmosphere. Another highlight of Metaspin is its loyalty program, rewarding loyal players with special bonuses and rewards.

- Futuristic and modern game offerings

- Cutting-edge graphics and innovative game features

- Attractive loyalty program with bonuses and rewards

4. BC.Game

BC.Game is a rising Bitcoin Casino, quickly making a name for itself with its diverse game selection and user-friendly platform. With an impressive range of crypto payment options, it's ideal for players who value diversity and flexibility. The range of games extends from traditional casino offerings to unique, proprietary games you won't find elsewhere. BC.Game is also known for its generous bonus offers and the inviting community feel.

- Diverse range of crypto payment options

- Unique, proprietary games

- Generous bonus offers and strong community

5. Slotland

Slotland is a paradise for slot enthusiasts and a renowned BTC Casino. This casino stands out for its exclusive selection of slot games, which are challenging to find in other online casinos. Each game at Slotland is uniquely designed, guaranteeing a one-of-a-kind gaming experience. Additionally, Slotland offers one of the best customer services in the industry, ensuring a worry-free gaming experience.

- Exclusive selection of slot games

- Uniquely designed games for a unique experience

- Excellent customer service

6. Betplay

Betplay.io is a dynamic Bitcoin Casino known for its lightning-fast payouts and the acceptance of a variety of cryptocurrencies. Players appreciate the wide range of games, from classic table games to innovative slots. The high-quality live casino experience that Betplay.io offers is particularly noteworthy. This casino is ideal for players who value speed, security, and a wide range of gaming options.

- Lightning-fast payouts

- Accepts various cryptocurrencies

- High-quality live casino experience

7. Greenspin

Greenspin is an eco-conscious Bitcoin Casino, distinguished by its commitment to sustainability and responsible gaming. Alongside a wide range of games, including many eco-friendly options, Greenspin offers attractive bonuses and promotions. The user interface is user-friendly and appealing, making navigating and playing on the platform a true pleasure.

- Commitment to sustainability and responsible gaming

- Eco-friendly game selection

- User-friendly and appealing platform

8. Bitreels

Bitreels is a modern BTC Casino that impresses with its staggering selection of over 3,000 games. From the latest slot games to live casino tables, Bitreels offers something for every taste. The platform is particularly known for its fast payouts and user-friendly interface, making it a favorite among online casinos.

- Impressive selection of over 3,000 games

- Fast payouts

- User-friendly interface

9. Empire.io

Empire.io is a stylish Bitcoin Casino, characterized by its elegantly designed website and high-quality game offerings. This casino offers an impressive selection of games, including many exclusive titles. Empire.io is also known for its lucrative VIP program, rewarding loyal players with exclusive bonuses and rewards.

- Stylish and elegant design

- Impressive game selection, including exclusive titles

- Lucrative VIP program

10. Winning.io

Winning.io is an exciting Bitcoin Casino known for its innovative game selection and excellent user experience. The platform offers a wide range of games, including many jackpot slots and live dealer games. Winning.io is also known for its fair gaming conditions and reliable customer service, making it a trustworthy destination for casino enthusiasts.

- Innovative and broad game selection

- Fair gaming conditions

- Reliable customer service

11. Cloudbet

Cloudbet is a leading Bitcoin Casino known for its comprehensive range of betting options, including sports betting and casino games. This casino impresses with its high-quality live casino experience and the variety of available games. Cloudbet is also recognized for its security and trustworthiness, making it a top choice for online gambling.

- Comprehensive betting range, including sports betting

- High-quality live casino experience

- High standards of security and trustworthiness

12. Bets.io

Bets.io is an emerging BTC Casino, notable for its user-friendliness and an impressive array of games. Its fast and secure crypto payment options are particularly commendable. Bets.io offers a rich portfolio of slots, table games, and live dealer games, all contributing to an exhilarating gaming experience.

- User-friendly platform

- Fast and secure crypto payment options

- Rich game portfolio

13. Trueflip

Trueflip is an innovative Bitcoin Casino, catching the eye with its unique underwater-world-like design and a vast selection of games. Known for its transparent and fair gaming mechanisms, as well as creative promotions, Trueflip also offers a unique token system that provides additional benefits and rewards to its players.

- Unique underwater-world-like design

- Transparent and fair gaming mechanisms

- Creative token system with additional benefits

14. 7Bit

7Bit is a retro-inspired Bitcoin Casino, characterized by its vintage graphics and a nostalgic gaming feel. Offering a wide range of both traditional and modern games, including many Bitcoin-specific options, 7Bit provides a unique gaming experience. The casino is also known for its generous bonus offers and dedicated customer service.

- Retro-inspired design and nostalgic gaming feel

- Wide range of traditional and modern games

- Generous bonus offers and dedicated customer service

15. Bitstarz

BitStarz is one of the most well-known Bitcoin Casinos, famed for its wide array of games and rapid payouts. This casino offers everything from slots and table games to impressive live dealer games. BitStarz is also notable for its regular tournaments and promotions, making the gaming experience even more thrilling.

- Wide array of games

- Rapid payouts

- Regular tournaments and promotions

What is Bitcoin?

Bitcoin is a virtual currency that is only available digitally. The name Bitcoin is made up of the words “bit” and “coin”. “Bit” stands for the smallest digital storage unit. “Coin” is the English word for coin. Bitcoin was created more than ten years ago and is still the most well-known and market-strongest cryptocurrency. Similar to the euro, bitcoin also has a symbol, “BTC”. There are now thousands of different “coins”, the most well-known include Ethereum, Litecoin and Bitcoin Cash (» more about cryptocurrencies in the casino). Different characteristics are present in cryptocurrencies. The majority of cryptocurrencies are created digitally and then traded on exchanges. Additionally, you can store the currencies in virtual wallets. For instance, creating a bitcoin requires a lot of computer processing power.

When referring to mining, the action is referred to as “mining” or “digging". The term “Satoshi” refers to the smallest Bitcoin unit. The phrase dates back to Satoshi Nakamoto, the alleged creator and inventor.

How does Bitcoin work?

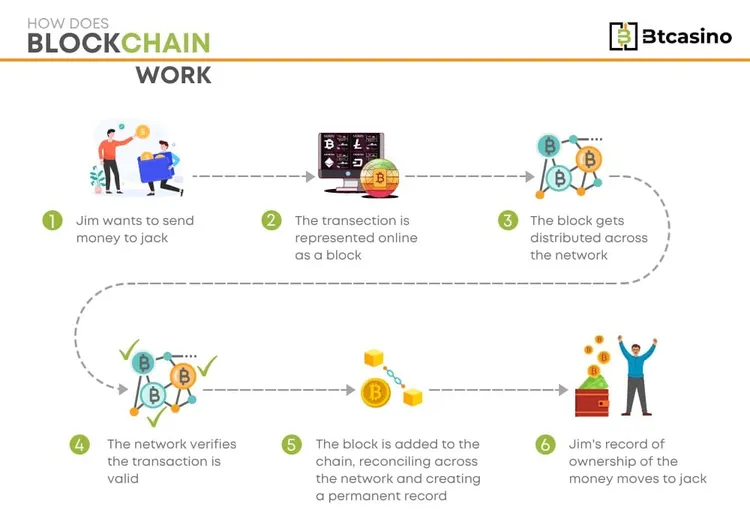

The way Bitcoin works, like most other cryptocurrencies, is based on blockchain technology.

Basically, a blockchain represents a shared data registry that is immutable. Each individual transaction represents a “block” in the chain that contains all the data of the movement. This block of data is linked to the previously chained blocks.

When further transactions are made by other users, they are also added as further links in the chain.

On this basis, a shared and common data network is created, which has an exceptionally high level of security. The security standard is because each individual data block is irreversibly linked to the surrounding blocks. This makes each individual block impossible to tamper with, as the entire data structure grants for the correctness of the data set.

How to buy bitcoin?

However, in addition to the underlying blockchain technology, there are many other elements that shape how cryptocurrency is used.

One of these aspects is the purchase of Bitcoin, the important first step into the world of cryptocurrencies. The path to your first own coins usually leads to a cryptocurrency exchange (e.g., Bitpanda) or a broker, where you can buy units of cryptocurrency for your fiat currencies. However, you should make sure that the exchange rate is as cheap as possible. Conveniently, most exchanges provide you with a large selection of transaction options with which you can make your deposit. For example, online payment service providers such as PayPal can often be used for transactions. Alternatively, it is recommended to have your credit card ready for the purchase. Credit cards also guarantee fast and secure transactions.

Bitcoin offers high anonymity

In addition to the numerous security measures, anonymity is another factor why Bitcoin has proven to be a popular digital payment method.

The anonymity is also related to the way the crypto wallet works. Since transactions are processed exclusively with the generated public keys, outsiders cannot deduce the real address and other personal data of the user.

This is an immense advantage compared to traditional payment methods such as bank transfers. With these, the IBAN is linked directly to the name of the account holder, which also allows the user's address to be found out.

Fun Fact: It is still unclear who created Bitcoin. Also unknown is whether Satoshi Nakamoto is an individual or a group. Many people have patented the invention in the meanwhile. The myth that has developed can be viewed as an element of cryptocurrencies' success.

Crypto gambling & Bitcoin gambling: Our guide for casino players

Cryptocurrencies have completely revolutionized both internet trading and stock markets. The stateless, digital currencies, meanwhile, have been around for a while and have established themselves as a method of exchange. This rule doesn't simply apply to online purchasing and trading in stocks; bitcoin gambling and cryptocurrency gambling have also gained popularity as alternatives to established online casinos.

Bookmakers are also increasingly offering the opportunity to place bets with Bitcoin. There is now a considerable selection of providers, and we will help you find a Bitcoin Casino that is right for you.

Here are some tips for getting ready to play at a Bitcoin casino. From selecting and acquiring cryptocurrencies to the top games for bitcoin and cryptocurrency gaming.

1. Choose a cryptocurrency

The first step to the best bitcoin casino is to choose the right cryptocurrency. The market is booming and there are many digital currencies out there, so it can be hard to get an overview. Basically, there are some coins that are particularly good for crypto gambling - foremost Bitcoin. Everyone is talking about this cryptocurrency, and it has the largest market capitalization. For this reason, the biggest profits have been made with Bitcoin in the past.

A popular alternative is Ethereum, the cryptocurrency with the second-highest market capitalization. For players who like to gamble with cryptocurrencies using smaller alternatives, Dogecoin or Bitcoin Cash offer viable options.

Caution: Don't let a cryptocurrency's pricing deceive you. An extremely low price could indicate a low market capitalization and be a sign of significant growth potential. However, it's also possible that there are already many coins in circulation, making the offer far more than the actual need.

Shiba Inu is a new cryptocurrency that preys on the ignorance of unsophisticated investors by offering high profit margins at an initially deceptively low price. You will learn how to prepare yourself for playing in a bitcoin casino in the next section. From cryptocurrency selection and acquisition to the top games for bitcoin gambling.

2. Create a wallet

In the next step, you have to get a suitable wallet. The wallet is a digital purse in which you collect the coins of your cryptocurrency. With your special wallet ID, you can make deposits and withdrawals in crypto gambling.

In terms of bank transfers, the ID is similar to an IBAN. However, keep in mind that there are several sorts of wallets; some are integrated into cryptocurrency exchanges, while others call for separate hardware.

3. Buy the cryptocurrency of your choice

Once you have created the wallet, you need to acquire cryptocurrency to be able to play in bitcoin casinos. The easiest way is to buy your cryptocurrency directly from an exchange or start with the vendor Faucet, build up a first capital.

Which Bitcoin casino should I start playing at?

Choosing the right casino is necessary for a good gambling experience. Luckily, there are a few points by which you can quickly spot the best bitcoin casinos:

1. Pay attention to the accepted payment methods

The first thing to check is whether your preferred bitcoin casino accepts your cryptocurrency as payment. You've wasted a lot of time if, for example, you discover after registration that the service does not allow Dogecoin play.

But you can avoid this by paying attention in advance to which cryptocurrencies are accepted by the respective casino. Players who are looking for Bitcoin Gambling have an advantage. Since bitcoin is the most well-known cryptocurrency, every bitcoin casino makes this currency available as a payment method.

2. Check the trustworthiness of the provider

Cryptocurrencies, particularly Bitcoin, have steadily increased in value over the past few years. This is why you should be cautious when selecting the provider you use for your cryptocurrency. The Bitcoin casino must provide dependable customer service. You may expect a secure environment and a point of contact should any questions or problems arise while using a professional service. For a satisfying gambling experience, selecting the correct casino is essential. Fortunately, there are a few indicators that will help you choose a trustworthy bitcoin casino:

Due to their strict requirements for gambling operations, Malta and Curaçao's gambling licenses are in particular regarded as being of the highest caliber. We only feature the Bitcoin casinos that pass our rigorous testing process and are in compliance with the law.

Caution: If you read about “Bitcoin Casinos without a license”, then this does not automatically mean a dubious provider. Currently, this refers to casinos that do not comply with the German transitional rule and consequently refer to their international authorization to operate gambling.

These providers have a license, but it is not necessarily from the respective country. The player protection and the seriousness of the provider can still be given.

3. Take advantage of bonus offers

Finally, you should always take a look at the bonus offers. These can make it a lot easier to get started with Bitcoin Gambling and help you earn profits. There are numerous types of bonus offers suitable for crypto gambling.

A no-deposit bonus offers a certain starting balance with which you can play your first rounds can. Much more common, however, are deposit bonuses, which give you a percentage surcharge on your first deposit.

Just as often, free spins can be found in the bonus offer. These make it possible to try out the provider's game portfolio, frequently free of charge.

Step-by-step guide to registration and first deposit

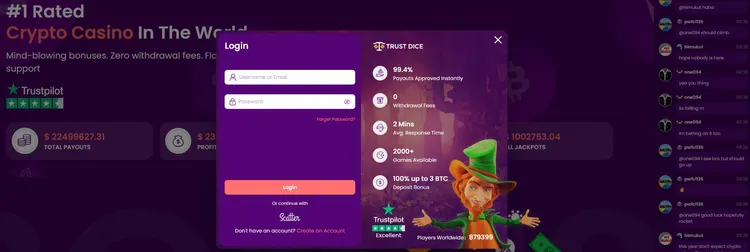

If you have now found a suitable Bitcoin Casino based on our reviews and your own test criteria, it is about the registration and the first deposit. Using TrustDice as an example, we now want to show you how this process works in a crypto casino:

Step 1: Account creation with TrustDice

Opening an account with TrustDice starts with visiting the website. Use this link to get an exclusive bonus of up to $25 to secure. The login field will pop up immediately. Below that, click on “Create Account”.

TrustDice will now ask you to enter your name, email address and password. In addition, you must accept the terms and conditions and can optionally register for the newsletter.

An email to activate the account will now arrive in your inbox. You will be transported to the TrustDice webpage after clicking the link.

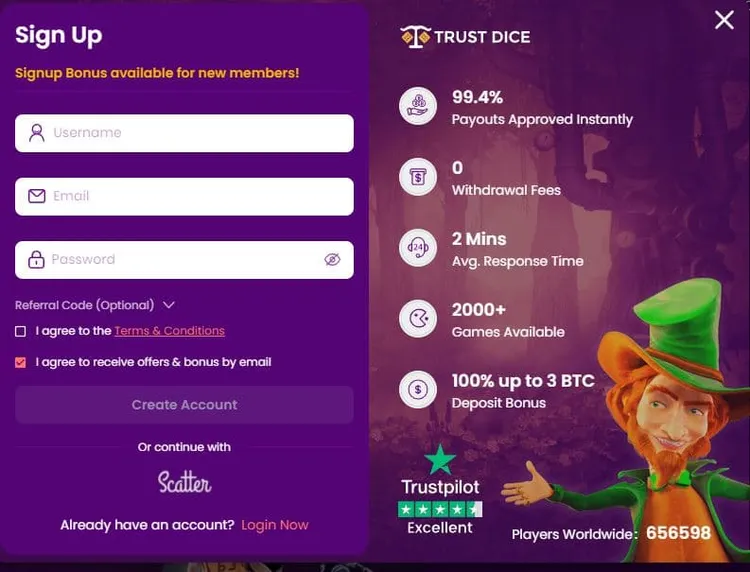

Step 2: Make your first deposit

Grab your first gifts under “Rewards” and type the code “FS202203280937” under “Bonuses” in your profile before making your first payment. You are given 10 Fire Lightning bonus spins as a result.

Various deposit alternatives are available on TrustDice. You can either transfer cryptocurrencies directly through your wallet or use your credit card or PayPal to immediately buy your preferred coins from reputable TrustDice partners.

Be sure to activate the welcome bonus before making your first investment (left). You will receive the payment in your player account shortly after making your deposit.

Step 3: Start playing

As soon as you make your initial deposit, you can start playing. Choose from many slot machine selections, card games, sports betting, and other choices.

Which casino games are suitable for bitcoin gambling?

There are many worthwhile games that may be played profitably with Bitcoin and Co. because cryptocurrencies are now widely employed in the casino industry:

1. Bitcoin Poker

Poker, the classic casino card game. Poker is particularly good for bitcoin gambling because there is a steady learning curve. With a bit of luck and skill, it is possible to win big. Since it is most exciting to play poker against other players, you should make sure that the provider makes this available in their live casino.

2. Bitcoin Blackjack

Blackjack is the safer option if you want to enjoy bitcoin gambling with a deck of cards. In blackjack, players have a small but important advantage over the house. Because of this, blackjack may not offer the highest winnings, but it does offer the best odds.

3. Bitcoin Roulette

One of the most popular table games in online casinos is Roulette. It embodies the classic casino atmosphere like no other game. If luck is right, big prizes can be won - thrills are guaranteed! Safe game strategies also exist, making roulette a flexible game for bitcoin gambling.

Advantages and disadvantages at a glance

If you don't have much time, just glance over this table's listing of a Bitcoin casino's benefits and drawbacks. You can discover more details down below if you're curious.

| Advantages | Disadvantages |

|---|---|

| + Fast speed | - No remittances |

| + Anonymity | - Loss of access data |

| + Bitcoin as an investment | - Entry can be difficult |

| + No fees | - Price fluctuations |

Bitcoin gambling: Advantages

There are many benefits to using Bitcoin when playing at an online casino. These benefits essentially have to do with the characteristics of the currency itself. There is no central authority, which is one of the main characteristics of Bitcoin and other cryptocurrencies.

Cryptocurrencies are independent of government measures or banking. This makes Bitcoin a very flexible and user-oriented means of payment. Especially around Bitcoin Casinos, the player benefits from these properties in the form of strong advantages:

1. Fast transactions

If you've chosen a Bitcoin Casino, you'll undoubtedly want to start playing as soon as possible and explore the variety of games. If you've decided to deposit through bank transfer, the transaction's processing could potentially take several days. A transaction with Bitcoin, on the other hand, is much faster. Since Bitcoin is a purely digital currency, deposits are processed in real time. This way, you can start playing within minutes - regardless of a bank's processing times.

You also profit from the quick speed in terms of rewards. You can get your prizes here practically immediately.

2. No fees

Anyone who often makes transfers on the Internet will know that there are usually fees. This can be a small percentage of the amount transferred or a fixed amount of a few euros. When there is a fee, it is always annoying. Especially in an online casino, a percentage fee reduces your profits. Again, since the cryptocurrency doesn't require a central authority, playing with Bitcoin will be advantageous in this situation. In an online casino, the bank or the payment service provider, which makes money on each transaction, frequently pays the fees.

This does not apply in a Bitcoin casino, so you can save large amounts over time. Only a network cost is kept, although this is typically within control.

3. Anonymity

The third advantage is the great level of privacy that Bitcoin users experience. This benefit is also provided by Bitcoin's lack of a central authority. When opening an account, Bitcoin Casino does not request any private information. In contrast to conventional online casinos, where you have to enter both your name and your address. In a bitcoin casino, however, you can be sure that your personal data stays with you and does not fall into the hands of third parties.

4. Bitcoin as an investment

The forecasts that the so-called “Bitcoin bubble” would burst have repeatedly turned out to be wrong. Although the cryptocurrency shows strong price fluctuations, the value of Bitcoin has still grown steadily on average. In light of this, the cryptocurrency has now shown to be a reliable financial investment. While the cost of the market is steadily rising, private bitcoin mining is getting more difficult.

A bitcoin casino is a good substitute for increasing your bitcoin stock. If you already have Bitcoin, getting started is simple, and with a bit of good fortune and gaming prowess, you can easily expand your Bitcoin holdings.

5. Bitcoin casinos are proven to be fair

A new technology known as “Provably Fair” enhances online gambling. The technology is primarily utilized in games and Bitcoin casinos. By definition, “Provably Fair” refers to an algorithm that examines and confirms if an online casino is treating its customers fairly. Most players no longer worry about being taken advantage of by online gambling companies because of this situation. As a result, it is possible to verify the fairness of each action, effectively eliminating the possibility of casino fraud.

Bitcoin compared to traditional payment methods

| Payment method | Deposit period | Payout period | Fees | User friendliness |

|---|---|---|---|---|

| Bitcoin | In a few minutes, money will be deducted from your wallet. | Up to 10 minutes, depending on the transaction block. | A lot of casinos take the fees. You can be charged extra if you utilize an exchange. | The primary benefit is speed. Although the wallet and exchange determine how simple it is to use, it is presently simple. |

| PayPal | Deposit is made immediately. | Up to 2 working days. | Generally speaking, there are no fees. Deposits made in foreign currency might be charged. | One of the most well-known suppliers of payment services, PayPal is quite user-friendly. However, PayPal has undoubtedly left German casinos, which is why there occasionally may be payment issues here. |

| Neteller | Credit is visible within a few seconds. | 1-3 days | Free of charge deposits. Fees may apply to withdrawals. | Neteller is now a significant player in the internet payments industry, much like PayPal. The user experience is straightforward as a result, making it simple to use. |

| Paysafe Card | The desired amount is available and readily apparent. | Paysafe Cards cannot receive deposits. | No fees | Paysafe Card is a payment method that is anonymous. Deposits are also effortlessly possible. Withdrawals, however, must be handled through your bank account or other options. |

| Klarna | The deposited balance will be credited in 1-2 business days. | 1-2 days | As a rule, no fees are charged by the provider. | Process payments securely with Klarna. These, however, are constantly connected to your bank account. |

| Trustly | Deposit requires only a few minutes. | Up to one day. | No fees | There is no requirement to register for a Trustly account. Usage is mainly anonymous as a result. Payouts are also made easier through collaboration with various European banks. An excellent option at Bitcoin Casino. |

| EcoPayz | The funds deposited from the eWallet are immediately credited to the player account. | 1-3 days | No charges for deposits. Only costs are charged when you transfer funds that have been paid out from your EcoCard to your bank account. | EcoPayz is unique in that users obtain a free EcoPayz MasterCard and can use it offline as a result of its simple setup and operation. However, not all casinos currently use EcoPayz, which can be a hassle for certain players. |

BTC gambling: Possible disadvantages

Apart from the important advantages, a Bitcoin casino has certain disadvantages. Most of them also depend on the lack of a controlling authority. However, these disadvantages are situational and rarely occur. If you are aware of the disadvantages and pay attention to your dealings with Bitcoin, you can avoid them in advance.

1. No remittances possible

You might easily complete an online transaction that is incorrect. As a result, you occasionally mistake a decimal place for a place preceding the decimal point. Additionally, mistakes could appear in the recipient address, causing your money to be sent to the incorrect person. You can get in touch with your bank and stop the transfer if something like that happens during a bank transfer. However, as Bitcoin has no central authority, there is no way for you to retrieve any Bitcoins that were transferred in error. Therefore, your chances of receiving a refund if you entered the wrong wallet address in the Bitcoin Casino are slim.

Be cautious when dealing with Bitcoin. Check the data of each transaction several times before confirming it. Especially with higher amounts, it is advisable to have a trusted person do a cross-check or to send a small test amount in advance.

2. Possible loss of access data

In most cases, all you need to create a user account in a bitcoin casino is your bitcoin wallet ID, a username, and a password. It will be challenging to recover your access data, though, if you should lose them. It is not feasible to re-verify you at Bitcoin Casino because you cannot supply any personal information. In this situation, the actually positive anonymity can become a problem, whereby your acquired cryptocurrencies are at risk. Accordingly, it is recommended that you store your valuable access data in several places. If you misplace a note or forget your access data, you have more notes in reserve.

Leave a note of your access information in your wallet or in your apartment, as well as on your laptop and smartphone. By doing this, you reduce the possibility that you will lose your data for permanent access. Under no circumstances should a two-factor authentication be lacking!

Important security tip: You must keep your secret key a secret if you store your cryptocurrency in a personal wallet. Access to your cryptocurrency will be lost if this is lost.

The majority of the Bitcoin casinos on our site cherish its clients' anonymity; therefore you should take extra precautions to protect your login information. Recovery is frequently impossible or very difficult.

3. Getting started can be difficult

One drawback is that it might be more challenging to enter a bitcoin casino, which can be problematic, especially for beginning players. Bitcoin may now be bought on exchanges, but doing so still needs some fundamental technological understanding. At first look, the rising cost of Bitcoin may also serve as a deterrent because a larger price drop may be possible.

4. Bitcoin price fluctuations

Many users consider the volatility of Bitcoin's price to be a drawback. But in a free market, price changes are a very typical phenomenon. Since it has been demonstrated that the price of Bitcoin swiftly rises after falling, its value has, on average, increased steadily over the past few years. Regarding Bitcoin casinos, this statement might be construed both positively and negatively. If you find yourself in a situation where the Bitcoin price falls again, it is advisable to remain calm. Refrain from taking your Bitcoin deposits out of your wallet or the BTC Casino right away.

By doing this, you might be able to prevent price losses. The likelihood of a future Bitcoin price recovery is forceful. You're doing this, you avoid unneeded losses brought on by feelings.

Why is Bitcoin the most popular currency in cryptocurrency casinos?

Many newcomers ponder the reasons for Bitcoin's dominance among cryptocurrencies in casinos. The most popular cryptocurrency on the market with the largest market cap is Bitcoin, which explains why. It has also been demonstrated that the price of Bitcoin, a cryptocurrency, is largely constant and is, on average, increasing slowly.

Therefore, online casinos that do not focus on cryptocurrencies will frequently provide Bitcoin as an additional deposit and withdrawal option. Although many casinos accept a range of various cryptocurrencies as a payment method, you can still use them even if you have alternative cryptocurrencies.

Different units of Bitcoin

The price of bitcoin has recently been chasing record high after record high. Thus, purchasing a full bitcoin is no longer as simple. The many exchanges allow for the purchase of almost any large fraction of digital currency.

The smaller unit of bitcoin is called “Satoshi”. Bitcoin casinos, on the other hand, have largely agreed on the subdivision of the following units:

- mBTC - Here we are talking about milli-Bitcoin. One mBTC is therefore converted to 0.001 Bitcoin.

- µBTC - This is Micro Bitcoin. One µBTC is equal to 0.000001 BTC.

So that you as a player do not have to laboriously count the zeros in the fractions of a bitcoin and thus avoid possible errors, these subdivisions are used to help.

The game selection at BTC casinos

The heart of every bitcoin casino lies in the selection of games. As a result, you will find numerous detailed game reviews at btcasino.info. In this way, we help you find the right slots, table or card games.

In the context of Bitcoin Casinos, it is important to know that the selection of games hardly differs from conventional online casinos. The game selection is therefore not a hurdle when switching from a conventional online casino.

The following are the main types of games that you may encounter in a Bitcoin casino:

1. Slots in Bitcoin Casinos

Slots means slot machines. Slot machines are among the most popular games at a bitcoin casino. The basic principle of slots is usually almost identical: A slot offers a certain number of reels, usually five, which have numerous symbols. The reels begin revolving vertically when a game round is initiated. The player must stop the reels and depending on which symbols are displayed, smaller or larger wins can be obtained. The order in which they appear is just as significant as the sort of symbol used. Therefore, winning lines must be considered. Wins only occur when a particular symbol appears on all three reels in the same position from left to right.

The choice of symbols depends on the theme of the slot. The selection is so large that you can be sure that you will find a slot that suits your taste. Particularly popular themes are slots in Egypt or Western optics. Classic designs like fruits are also very popular because they are associated with arcades with mechanical remember slot machines.

2. Table games at Bitcoin Casinos

Slot machines and table games both contribute to the genuine Bitcoin Casino experience. In the table games section, you will find all known games that are also offered in real casinos. These include, for example, the popular Blackjack or other card games such as Poker. A high-quality Roulette table is also part of every professional Bitcoin casino. In addition, most casinos offer baccarat as an alternative to the other card games. Thanks to online casinos, you can play these timeless classics from the comfort of your own home. So, you can experience the real casino atmosphere in peace and quiet.

The card games' significant strategic component, which ensures that your success does not solely depend on luck, makes them more intriguing. This function is crucial when using bitcoin to play because it enables you to maximize your winning potential.

But also dice games are finding more and more followers in the Bitcoin Casino and promise fair winning opportunities.

3. Live casinos with Bitcoin

The Live Bitcoin Casino is subject to the same rules that apply to the table games. You can discover it in the live casino if the casino ambiance provided by the table games is insufficient for you. Live games are available in a separate category at reputable online casinos. With live games, you connect with like-minded players via the Internet and play exciting table games in real time. These games also employ real staff. For example, there is a professional dealer in blackjack in the live casino. German bitcoin casinos have also discovered the live casino for themselves, so you can play for the coveted cryptocurrency in real time.

The game portfolio in the live Bitcoin Casino usually corresponds to the game selection of the table games. This means that you can also Blackjack, Poker, Roulette and Baccarat enjoy. If you value enjoying exciting game rounds together with other players, you are in good hands in the live Bitcoin Casino.

Possibilities of a Bitcoin Casino Bonus

In addition to the game selection, the bonus offer of an online casino is the most important aspect for many players. A well-thought-out welcome bonus can make it noticeably easier for new players to get started. Also, in the case of a bitcoin casino, a strong bonus can ensure that players have greater chances of winning worthwhile profits.

The bonus types hardly differ between conventional online casinos and Bitcoin casinos. Both casinos offer the same types of bonuses. The most common types of bonuses are presented below. This way you can check which bonus you like the most and take that into account when choosing a new bitcoin casino.

Bitcoin deposit bonus

One of the most famous bonuses is the deposit bonus. Moreover, in Bitcoin casinos, deposit bonuses are very popular. With a deposit bonus, the player receives a percentage markup on their deposit. Here is an example:

- A casino offers new customers a deposit bonus of 100% on up to two bitcoins.

- As a new customer, you are ready to deposit 0.25 BTC.

Your deposit will be doubled, giving you a total of 0.5 BTC

Important: Note the respective turnover conditions! The bonus provided is linked to conditions in almost all cases. You can find all the information you need on btcasino.info under the T&Cs of the respective providers.

An example of such a requirement is that the bonus amount must be wagered 30 times. In our example, the player would have to wager a total of 0.25 × 30 = 7.5 Bitcoin in the casino before he can withdraw his bonus of 0.25 Bitcoin.

These conditions are usually set very high and are therefore relatively difficult to achieve. Ultimately, however, this is to be seen positively: If you are actually successful, you have doubled your deposit and probably reaped decent profits.

Bitcoin casino no deposit bonus

An alternative to the deposit bonus is the no-deposit bonus. In this case, the player receives an amount of money that is independent of the amount of his deposit made. A no deposit bonus is offered less frequently than a deposit bonus.

Oftentimes, a no deposit bonus is associated with a Bonus Code that must be provided to unlock the bonus. Since such a bonus is free credit, it is always advisable to use it.

This is especially true for Bitcoin Casinos in German, as there are hardly any such bonus offered there. Here, too, certain sales conditions typically apply before payout.

Bitcoin Casino “Free Spins”

Another popular type of bonus at Bitcoin Casino is “Free Spins”. These are often offered by online casinos in addition to a deposit bonus. “Free Spins” are free rounds of play on slots that players can use to experience extra gaming fun and earn additional winnings.

The Bitcoin Casino typically offers selected games for which the free spins can be used. Although this restricts you a little, you have the opportunity to get to know new slots without taking any risks. In some cases, the full game portfolio is available to you.

Bitcoin casino cashback bonus

The payback bonus is another variety of bonus. Cashback, which refers to the return of money, gives the player the benefit of receiving some money spent on games back into his account. For players that are security sensitive and want to “minimize” their losses, this passive impact is especially intriguing.

There are two types of cashback benefits. Only a small fraction of the total stake is repaid in the first option. Only a small part of the actual losses are offset by the alternative.

Bonus Glossar

Different terminology that isn't always clear are used by bitcoin casinos. Listed below is a brief explanation of the keywords.

| Term | Explanation | ||

|---|---|---|---|

| Minimum payout amount | This is the minimal amount you may withdraw for each withdrawal. | ||

| Maximum withdrawal amount | The majority of bitcoin casino bonus deals have a percentage-based maximum withdrawal amount. You are only permitted to withdraw up to 100% of your bonus deposit. There are occasionally also overall withdrawal caps. | ||

| RTP | Return to Player is referred to as RTP. In the casino, this term refers to the amount of money that an online casino game ideally pays back to its customers. | ||

| Betting limit | To connect the payout of a bonus to specific slots or a specific number of games where you must win the set wager, online casinos typically have a wagering requirement. | ||

| Bonus code | To use a bonus at some Bitcoin casinos, you must enter a promo code. This code is made up of both letters and numbers. All applicable bonus codes are listed in our reviews. | ||

| Provably fair | Most Bitcoin casinos use this new technology. It is an algorithm that examines and confirms whether a crypto casino is fair to its customers. | ||

| No deposit bonus | By merely signing up for an account at a bitcoin casino, players might receive a no deposit bonus. Free spins or credits may be offered as part of the promotion without requiring a deposit from the player. | ||

| Welcomebonus | When you sign up at an online gambling site, you usually receive a welcome bonus. Giving yourself extra points for playing online games. | ||

| Cashback | Similar to a money-back guarantee, an online casino's cashback bonus enables players to receive a set percentage of their losses returned as bonus credits or bitcoin. |

Deposits and withdrawals at Bitcoin Casinos

Customers at online casinos have access to a variety of deposit and withdrawal options. They can guarantee a high level of comfort for their clients in this way. Credit cards and e-wallets like Skrill or Neteller are available as deposit and withdrawal options in every reputable online casino.

These payment methods, however, are either not used or used in addition to Bitcoin casinos. As an alternative, there are other cryptocurrencies to pick from. This improves the overview and streamlines the area of deposits and withdrawals.

Secure storage options for Bitcoin

But not only the purchase of Bitcoin follows specific patterns. The custody of the purchased coins also requires a certain service. This is the use of a crypto wallet - a digital wallet where you received Bitcoin are stored and kept safe for you.

There are many providers for wallets with different service offerings. Sometimes, crypto exchanges also offer their wallet, which is particularly convenient.

The basic principle of a wallet is based on the generation of keys. There are two types of keys, public and private. A public key is similar in function to the IBAN of a bank account and identifies the user's wallet. A private key, on the other hand, is the access authorization for your wallet. It works similar to a PIN, with which you can access your cryptocurrencies.

More modern wallets make additional use of innovative key generators, which create numerous keys as needed. This feature considerably increases the security level of wallets because each key can only be used once and is then invalid. This mode of operation is reminiscent of the TAN procedure, which also provides temporary PINs.

Regardless of this basic mode of operation, a wallet can take very different forms, all of which provide their advantages:

1. Software-wallets

A software wallet is a specially developed application that must be installed on your device.

2. Online-wallets

With an online wallet, your data is secured on the provider's website. An example of this variant are the wallets offered by cryptocurrency exchanges.

3. Hardware-wallets

Hardware wallets are a very fascinating solution for Bitcoin storage. As the name suggests, it is not a purely digital application. Instead, you receive a physical device from the provider that generates keys offline. This variant is particularly secure, as hackers cannot gain access to the offline wallet in this way.

The only problem, although very rare, would be technical failure and damage to the key generator.

4. Paper-wallets

Paper wallets are generally considered the most secure option. The provider prints both the public and the private key on paper, often in the form of a QR code, and makes it available to you. This variant of Bitcoin security is not only protected from hackers, but also from technical failure. The only important thing here is that the paper is kept safe. If you plan to keep the key papers for large Bitcoin assets safe, even buying a small safe would be advisable.

Bitcoin as an investment

The previously discussed aspects mainly focused on the use and functionality of Bitcoin as a digital means of payment. However, the second major area of application of the cryptocurrency should also be discussed at this point.

We are talking about trading and investing in Bitcoin for the long term. After Bitcoin was considered an exotic development in 2009, the cryptocurrency has turned out to be a real stock market miracle in the past 14 years. Meanwhile, Bitcoin, as the pioneer of cryptocurrency, has become an indispensable part of daily economic life.

It is noteworthy that the price of Bitcoin has always grown on average, despite some price drops. For example, the cryptocurrency reached a value of over USD 29,000 at the beginning of the year.

The two price slumps in 2014 and 2018 are striking. A mistake that many investors make at these times is to react prematurely to the price change and to sell their coins.

The error becomes apparent when you take a look at the respective following years (2014 and 2018, respectively). As you can see, by the end of the following year, the bitcoin price had already recovered to a level that was even stronger than before the price collapse.

The development of the share price can also be seen obviously in the following chart:

The aforementioned slumps in 2014 and 2018 are clearly recognizable. Equally, clearly recognizable, however, is the rapid recovery of the share price. Accordingly, investors who have prematurely or reactively dissolved their Bitcoin portfolio should be annoyed.

All investors who have held on to their bitcoins are likely to have made lucrative gains from the price recovery.

Bitcoin alternatives

| Kryptowährung | Anzahl an Casinos |

|---|---|

| Ethereum Casinos | 28 |

| Litecoin Casinos | 26 |

| Bitcoin Cash Casinos | 25 |

| Dogecoin Casinos | 25 |

| Tether Casinos | 22 |

| Binance Coin Casinos | 15 |

| Cardano Casinos | 11 |

| Dash Casinos | 7 |

| Shiba Inu Casinos | 6 |

| Tron Casinos | 5 |

Bitcoin Mobile Casino

Today's gamers expect to have mobile access to their favorite games with ease. The future of gaming is this behavior, as every adult and child constantly has a smartphone on them. As a result, contemporary gamers like taking a quick break from work or school to play their favorite games at the Bitcoin Casino. Early on, online casinos identified this trend and made investments in mobile gaming. Because of this, every reputable online casino now provides a mobile version that enables easy gambling on the go. Bitcoin casinos are also included in this. Because of this, you can be confident that the Bitcoin Casino you've chosen has a mobile version as well. Mobile casinos often fall into one of two categories. The first possibility is that the service provider provides a casino app. This must be downloaded from the Apple App Store or Google Play Store. However, this variation is now out of date, thus the majority of Bitcoin casinos have found a replacement for themselves: a mobile-friendly website. The web browser on a smartphone or tablet can be used to access the mobile casino. This variation offers two benefits:

- The player does not need to download an app.

- The mobile version of the casino works regardless of the operating system of the smartphone.

A Bitcoin casino represents a strong opportunity for casino and crypto fans!

You can enjoy benefits when playing in a Bitcoin casino that are not available to you when playing in a regular online casino. As a result, you can benefit from fee-free or very low-cost transactions for deposits and withdrawals.

You may be sure that your personal information is secure because no other money provides such a high level of anonymity. Cryptocurrencies do, of course, have some drawbacks, but they can be avoided with a little forethought and cautious management beforehand.

The functionality of bitcoin casinos is in no way less than that of traditional online casinos. You can therefore choose from the same variety of bonus offers as you can at conventional casinos. You can access the whole game library in a bitcoin casino. So, you may enjoy all new releases as well as your favorite games.

Bitcoin Casino FAQ

Bitcoin is no longer a novelty as a payment method in casinos, but also beyond that. However, issues can come up, particularly in relation to transactions and deposits and withdrawals.

Here, we've compiled the most crucial inquiries about Bitcoin casinos as well as other nations, and we've provided succinct and straightforward answers to each of them:

The majority of the time, casinos don't impose any fees for Bitcoin transactions. However, transmitting cryptocurrency frequently results in network fees. Since they are typically quite cheap, the virtual money might be viewed as an alternative to traditional currencies.

This inquiry relates to the issue of whether Bitcoin or a lesser quantity like mBTC can be used in the Bitcoin Casino, or if a conversion into conventional money is required.

There is no universally applicable solution to this query regarding casinos. In general, alternative digital currencies are becoming more and more the focus of providers. While some online casinos exchange Bitcoin for euros before players, the majority of more recent casinos that focus on cryptocurrencies also enable players to use the digital money.

Cryptocurrencies may be utilized for both deposits and withdrawals at any of the Bitcoin casinos listed on this website.

A Bitcoin payout takes much less time than a traditional distribution like a bank transfer. This requires that the transaction be made through a trusted wallet or exchange. This fact represents a significant advantage over traditional forms of payment, which take at least a day.

Almost every casino offers a new customer bonus. This is no different with bitcoin casinos. But don't be fooled by the height alone - it's at least as important to take a look at the wagering requirements. We are constantly testing the most attractive bonus offers on the market and summarize the most significant information for you together.

TrustDice currently has the fairest and best offer on the market. There you will receive up to the equivalent of $25 in Bitcoin and all without making a deposit. Moreover, there are free spins, deposit bonuses and much more.

The Bitcoin price has been extremely volatile since its inception. This consequently leads to a higher risk for you. Profits from a casino can therefore have a positive or negative impact on the result due to exchange rate fluctuations. We have researched more information here for you.

In theory, the answer to this query is "Yes." The license is primarily responsible for the seriousness. A casino that accepts deposits in Bitcoin or other cryptocurrencies varies from conventional suppliers only little.

Naturally, there are bad apples everywhere. Be at ease, though! In response, we are here. We thoroughly investigate each supplier so that you can be certain to choose one with a good reputation.

No. Because of the blockchain's cryptography, a cryptocurrency transaction cannot be undone. To cancel the deposit, you may only get in touch with the relevant Bitcoin casino's customer support. The relevant terms and conditions explain if fees apply or whether this is even possible.

By hybrid casinos we mean providers that accept both cryptocurrencies and fiat currencies. In contrast, you can now find numerous providers on the market that exclusively offer cryptocurrencies. We recommend these casinos first. There, you can be sure that bonus offers and games are tailored to digital currencies.

This is not possible in pure crypto casinos. There’s you can only deposit with different cryptocurrencies. However, there are hybrid casinos that additionally accept fiat currencies and in some cases also accept deposits with PayPal.

Bitcoin Slots are no different from traditional slot machines. However, there are some slots that were created exclusively for cryptocurrencies and that you will only find in Bitcoin casinos.

As you read, there are several advantages to bitcoin and cryptocurrency gambling over traditional online casinos. Cryptocurrencies are generally enjoying increasing popularity, with a large selection of different providers with specialized bonus programs.

We have now created a comprehensive database of casinos, which we have tested in detail and shared our experiences with them. Look at our ranking to find the top bitcoin casinos.